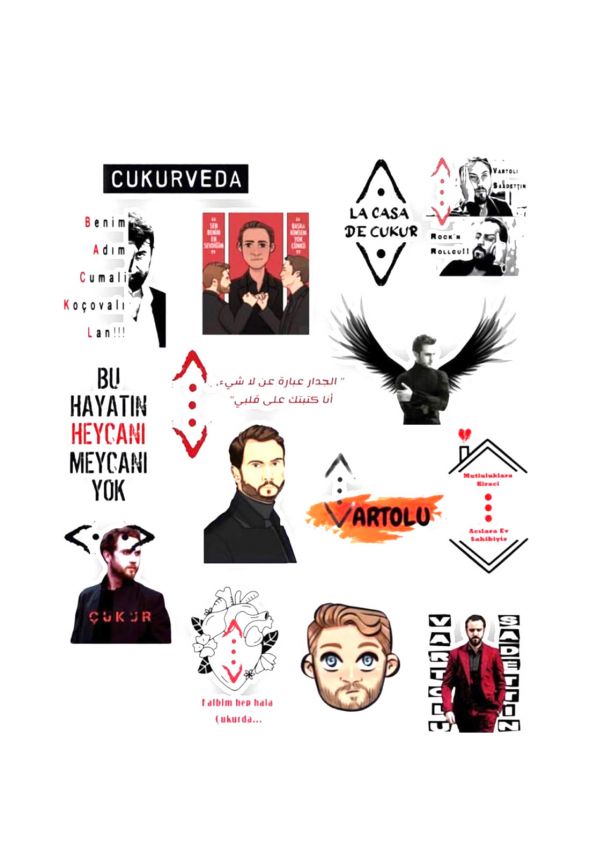

عبدالله ادالي on X: "والمتجر يقدم تصاميم وتشكيلة من اكسسوارات الحفرة <•••> والاكواب والسلاسل الناعمة وأيضاً كابات سبورت وخواتم استيلر الكروم الأسود "يشحن لجميع مناطق المملكةو لجميع الدول 🌍" (لطلب) عبر الواتساب:

on X: "الفن المبدع و المتقن = الانتشار الفنون هي مصدر السياحه و التجارة شعار الحفرة اللي شاف المسلسل او ما شافه والا مر عليه صور الشعار بكل جدار مرسوم وكافيهات

فيولا للعطور والإكسسوارات - الى عشاق مسلسل الحفرة <•••> وبطلها آراس بولوت (يماش) تم توفير طقم الحفرة المميز يتكون من خاتم + قلادة + سوار جميعها مختومة بختم الحفرة وبسعر 15 ألف

عبدالله ادالي on X: "والمتجر يقدم تصاميم وتشكيلة من اكسسوارات الحفرة <•••> والاكواب والسلاسل الناعمة وأيضاً كابات سبورت وخواتم استيلر الكروم الأسود "يشحن لجميع مناطق المملكةو لجميع الدول 🌍" (لطلب) عبر الواتساب:

طقم مج مطبوع بطبعة ياماك كوتشوفالي من مسلسل الحفرة + قاعدة اكواب + سلسلة مفاتيح : Amazon.com: Everything Else