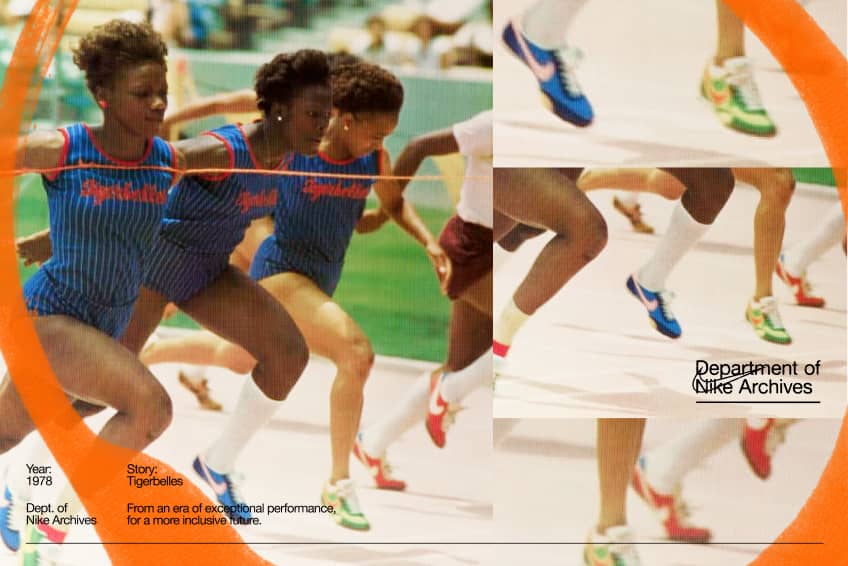

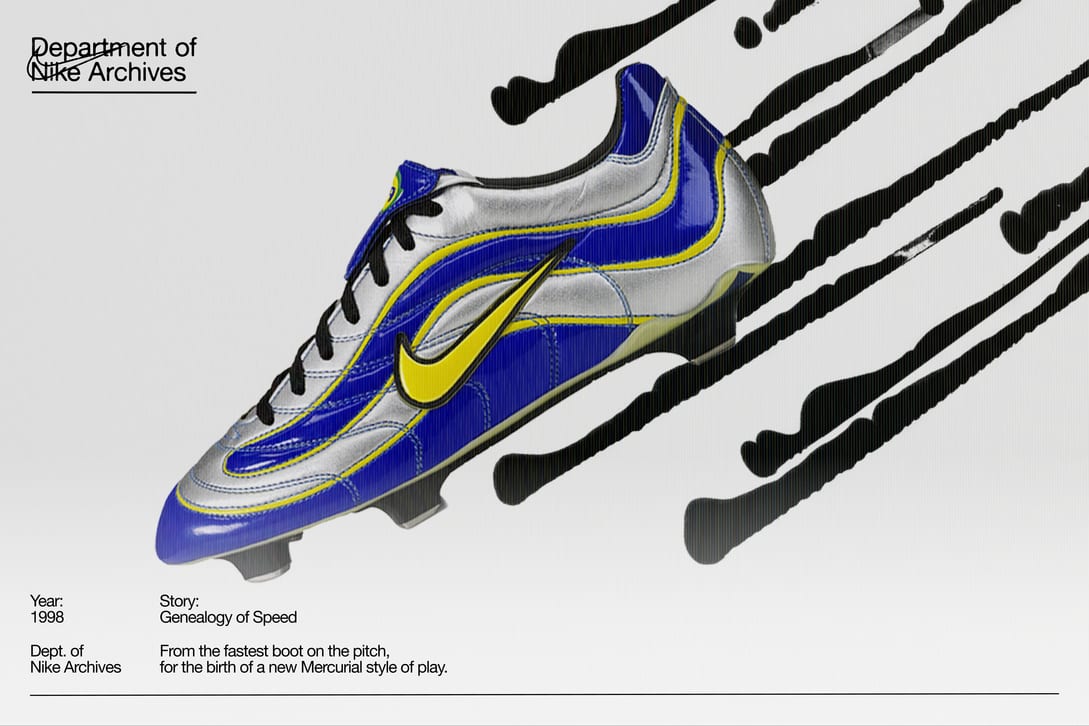

Inside the Department of Nike Archives at Its Portland Headquarters - Coveteur: Inside Closets, Fashion, Beauty, Health, and Travel

Archive SA - The Nike Sportswear Air Force 1 '07 Lux captures the iconic look of its 1982 predecessor with soft cushioning and premium detailing. Shop yours now for R1,599.95: https://bit.ly/2KYxqOp | Facebook

Inside the Department of Nike Archives at Its Portland Headquarters - Coveteur: Inside Closets, Fashion, Beauty, Health, and Travel

Inside the Department of Nike Archives at Its Portland Headquarters - Coveteur: Inside Closets, Fashion, Beauty, Health, and Travel

Archive SA - One of Nike Sportswear 's most influential silhouettes of the year. The Nike Air Force 1 'Shell' just dropped in an all-black colourway. Shop yours now for R2299.95 at

![A Look Inside the Nike Archives [PHOTOS] A Look Inside the Nike Archives [PHOTOS]](https://footwearnews.com/wp-content/uploads/2017/02/nike-air-max-93.jpg)

![A Look Inside the Nike Archives [PHOTOS] A Look Inside the Nike Archives [PHOTOS]](https://footwearnews.com/wp-content/uploads/2017/02/nike-air-max-1-1987.jpg)