Шлайфащ камък за машина за заточване Scheppach за TIGER 2500 Ø 250 x 50 x 12 мм, K 220 / Scheppach 89490701 / - Топ Машини Онлайн - Вашият магазин за машини и консумативи

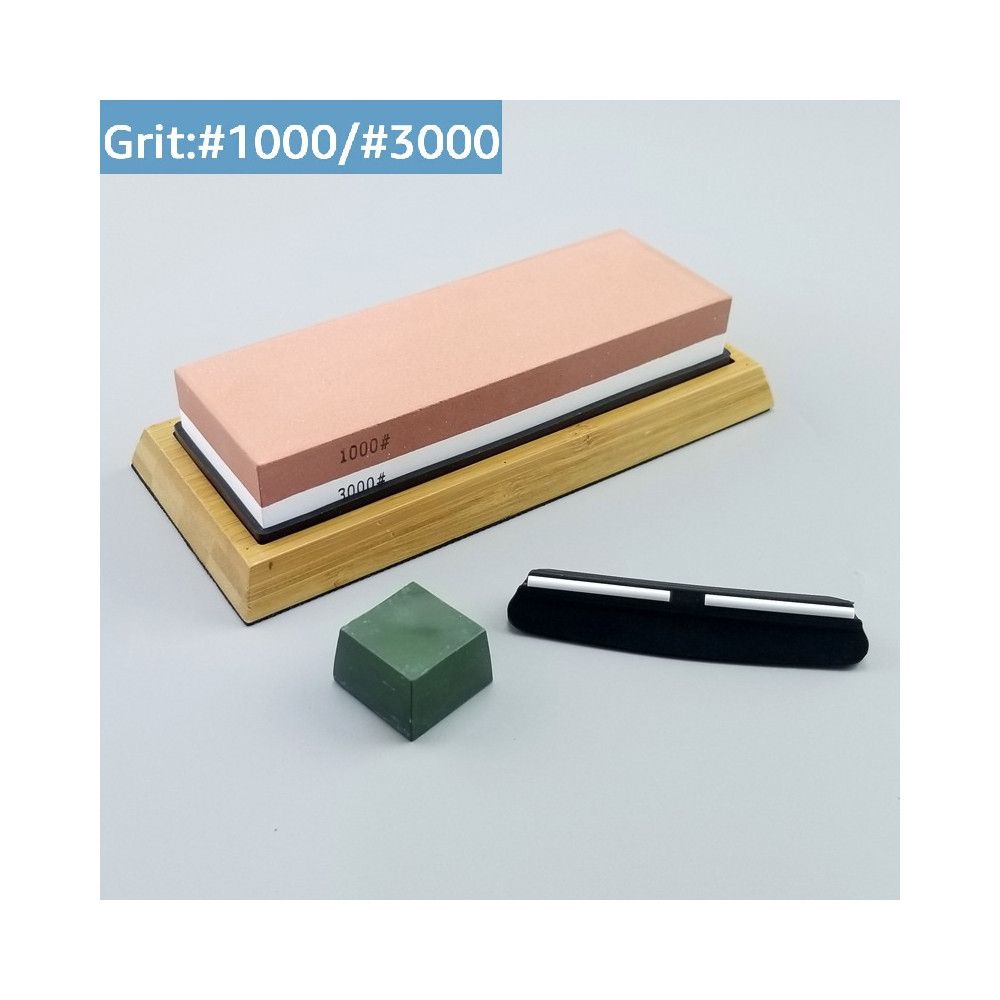

BellFyd® Комплект камък за заточване на ножове за заточване BellFyd® 2 зърна, 1000/6000, включен ъглов водач, заточване, довършване, изправяне - eMAG.bg

Заточване ножове БЕЛГИЯ Тиролит Камък на керамична основа в Други инструменти в гр. София - ID37994895 — Bazar.bg

Диск за заточване Tyrolit на циркулярни дискове прав профил розов 150 мм, 32 мм, 20 мм, 98A 60K 9V 3 40 | Tashev-Galving

Диск за заточване Tyrolit на циркулярни дискове прав профил 150x20x20 мм, прав профил, 96A 60 N7 V40 – Gami.BG

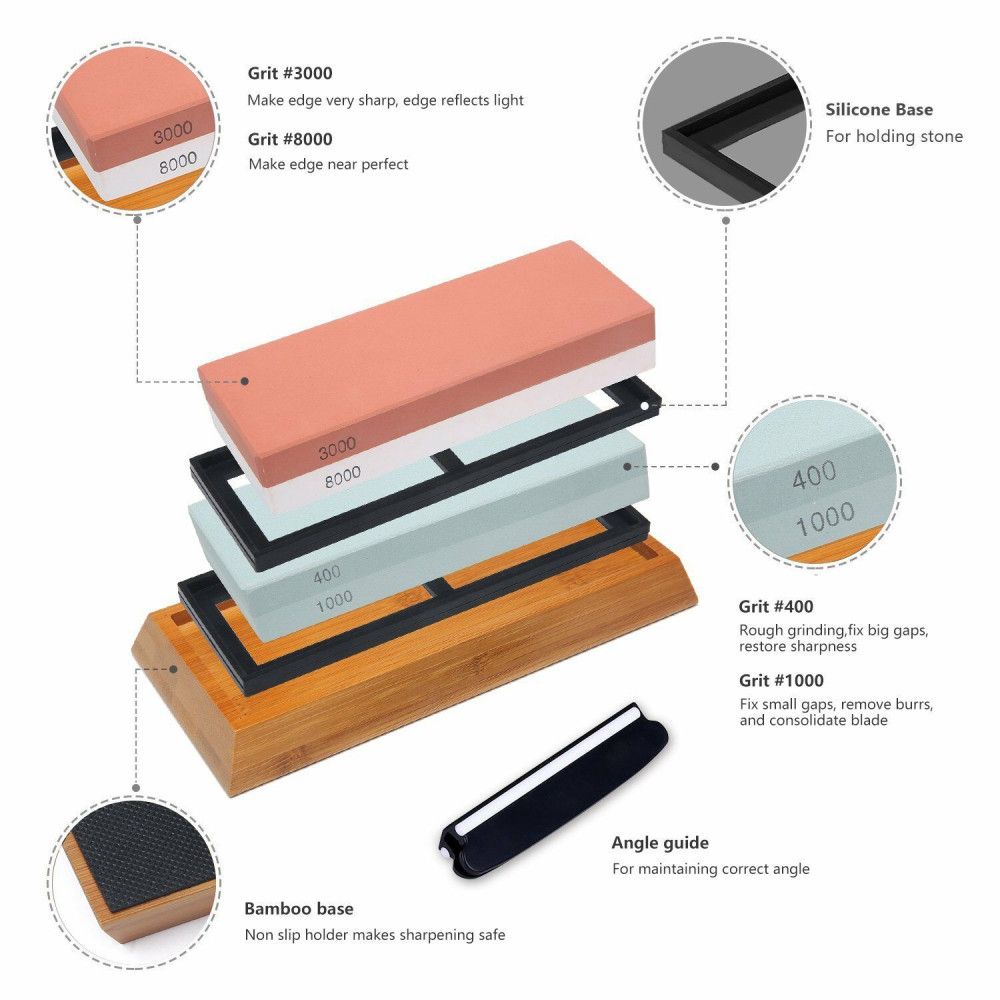

Комплект камъни за заточване на ножове AmXea 400/1000 и 3000/8000, С камък за изравняване, Бамбукова стойка и нехлъзгаща се гумена основа за заточване - eMAG.bg