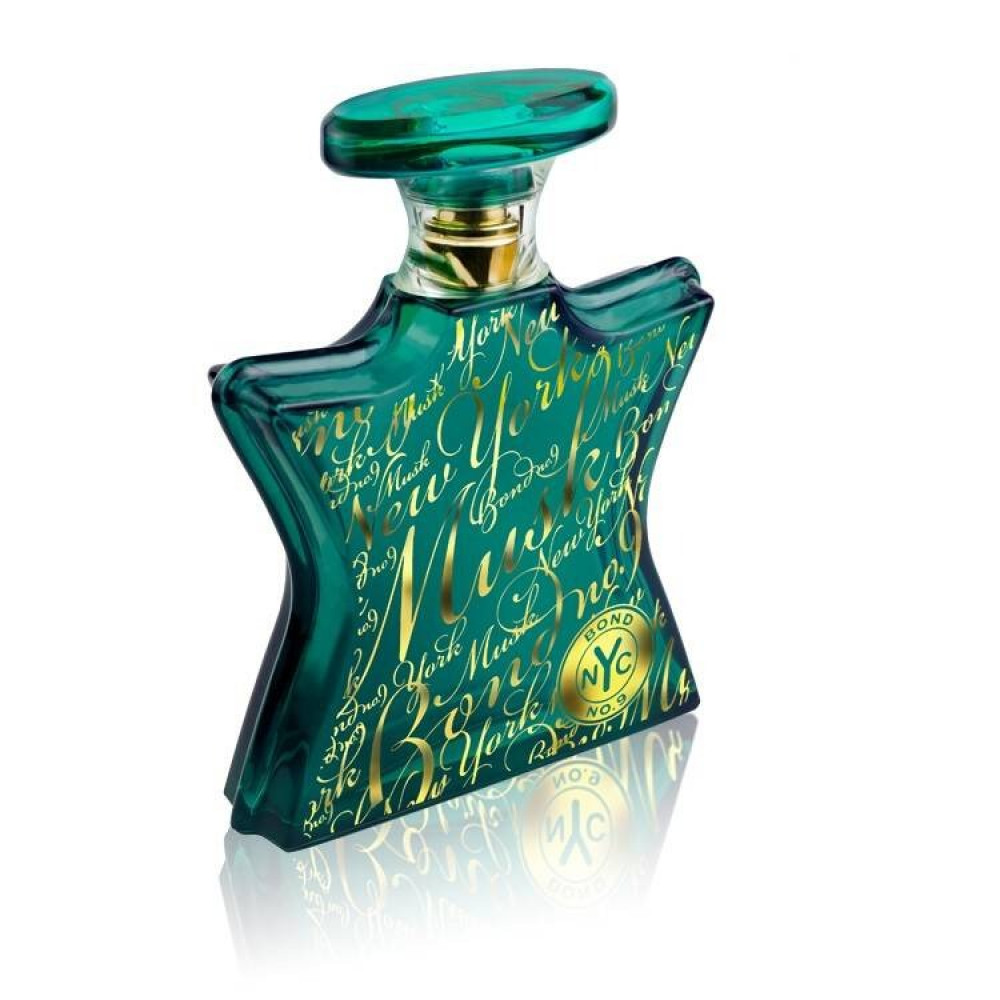

بوند نمبر 9 ذا سينت اوف بيس للنساء - او دي بارفان, 100 مل: اشتري اون لاين بأفضل الاسعار في السعودية - سوق.كوم الان اصبحت امازون السعودية

بوند نمبر 9 ذا سينت اوف بيس للنساء - او دي بارفان, 100 مل: اشتري اون لاين بأفضل الاسعار في السعودية - سوق.كوم الان اصبحت امازون السعودية

Amazon.com : Bond No. 9 The Scent of Peace For Him - Eau de Parfum 3.3 Fl. Oz. : Beauty & Personal Care

عطر بولغاري مان تيري اسنس او دو بارفيوم 100مل متجر خبير العطور - متجر خبير العطور Perfume Store عطور اصلية باأفضل الاسعار

Statue of Liberty Bond No 9 West Side Eau De Parfum Perfume Bond No. 9 Eau De Parfum، Liberty Island, عطر, كهربائي png

بوند نمبر 9 ذا سينت اوف بيس للنساء - او دي بارفان, 100 مل: اشتري اون لاين بأفضل الاسعار في السعودية - سوق.كوم الان اصبحت امازون السعودية